Why should NFTs have value

A no hype fundamental framework on how to look at NFTs and applications in the real world.

What the hell are NFTs

Non-Fungible Tokens (NFTs). A fanciful term that quickly became a tiresome buzzword overused into obscurity by influencers and mainstream media. Lets break it down into simple human words. Fungible means things that are the same. My $1 and your $1 is the same, they are fungible. Your 1 bitcoin and my 1 bitcoin is also fungible. As such, non-fungible means items that are distinguishable and not interchangeable. My iPhone and yours might be of the same model, but are different in user history, personalization settings and production serial number.

Tokens are even simpler. A token is simply a unit of measurement. I couldn’t have explained it better than Punk6529’s tweet below:

Altogether, NFTs are just different distinct pieces of paper. Sounds a little dramatic, but that’s the idea. If you are reading this, you should be familiar with the internet. Hence, we shall condense the understanding of NFTs as unique “digital files” (this is important).

Being an NFT doesn’t mean its special

If NFTs are just digital files, what makes them special? To NFT non-believers, they should be familiar with hearing the common rebuttal that “NFTs have value because they are scarce. There is only 1 (or 10,000) <insert NFT name> in the world and you can be the owner of it.”

Yes, you can’t just copy & paste someone’s JPEG image because this artist minted it on the blockchain and can be verifiably proven that this unique digital file currently belongs in this owner’s digital wallet. However, having scarcity alone does not drive demand. For example, I may have a piece of rock that is very unique in this size, shape, texture, composition of minerals against other rocks, but it does not have any meaningful value.

Sadly, Ether Rocks are not really proving my point, but we will get there later. In the next section, you will find the what drives demand and value are usually very traditional stuff.

So what gives NFTs their value

We can break it into 2 camps—perceived value and functional value.

Perceived value

I believe most of the NFT value today comes from perceived value. We do not have the infrastructure and adoption yet for truly functional use cases. However, this does not mean that there are no real value at all. Perceived value also means intangibles. In the traditional world, those “intangibles assets” sitting on companies’ balance sheet accounts for things such as Brand Name and Intellectual Property (IP) rights. As of 2020, 90% of all assets in the S&P 500 are intangible, although this also includes customer data and software.

Chris Dixon famously wrote that the next big thing will start out looking like a toy. This is where we are at now with NFTs, being dominated mainly by the Collectibles genre:

Collectibles command a lot of perceived value as they are not inherently costly to make or have functional purpose. There is no lack of extravagant, million dollar sales of collectible stamps, comic books or trading cards in human history. The paper and cupboard used to make these things cost comparatively next to nothing (like your digital files on the blockchain). The functional purpose of rare stamps or watches is no different from their average counterparts. The most expensive Pokémon cards are not even necessarily the most OP in its card game.

The answer to the value of collectibles is in the name itself. People like to collect things. The same art collectible can be enjoyed in the museum or printed out from the web, but it is the act of owning an authentic piece that somehow makes the item more meaningful to you. There can be many reasons for owning collectibles, such as the item being — a social identifier, reflection of personal taste, display of fashion sense, expression of culture or just community hype. Same reasons can apply to NFT collectibles.

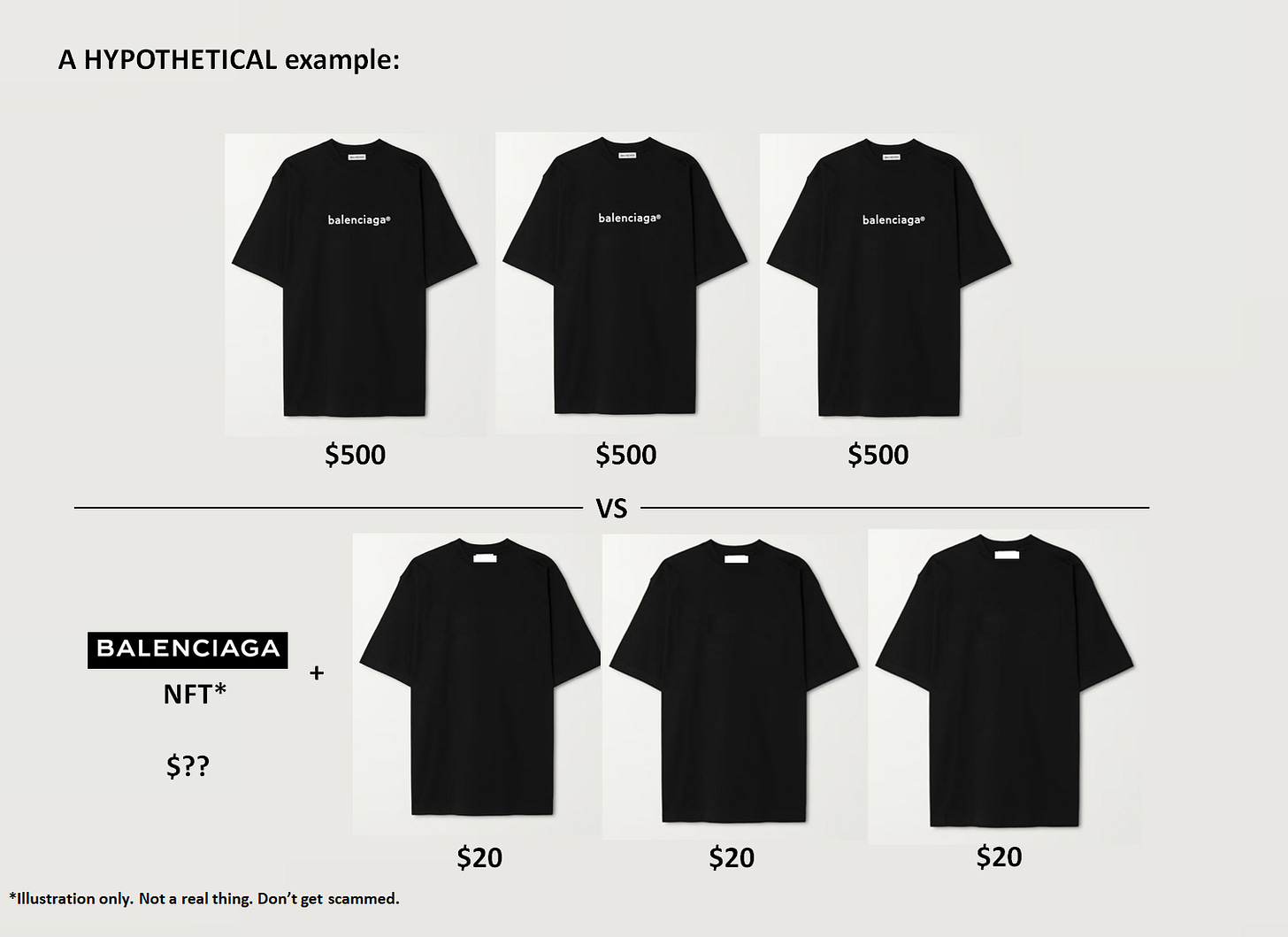

The cool thing is the digital aspect of NFTs means you own just the intangible brand value, without the physical constrains. If NFTs can promise digital permanence, we do not need to worry about physical deterioration and storage for our prized collectibles. Some owners and museums display replicas of rare artwork due to strict maintenance requirements, missing originals or just human stupidity. With Augmented Reality (AR), maybe we can just wear our NFTs in the future. If you can just buy the brand, print or use AR to wear it, will physical luxury goods become obsolete?

Know your NFTs

NFTs are rules-based social constructs that make it possible to own a piece of the brand or culture. That brand or culture explains the exorbitant price tag of pioneering NFT collections such as Crypto Punks and Ether Rocks. Historical significance has always in been an important factor of perceived value, as seen in the luxury collectible stamps, comic books and trading cards games. But what about the rest?

It is easy to call crazy on these internet pictures costing thousands of dollars. But most of the time, the picture does not represent the full value of the NFT. Take the Moonbirds collection for example. The art of pixelated birds is nothing revolutionary. However, they certainly broke new records when their ~8,000 Moonbirds NFTs public sale this year was oversubscribed at a selling price of 2.5eth each, and proceeded to trade up to 38.5eth floor price (15.4x gain) at its peak within a few days of release. Eth was worth roughly US$3k at that time. Although there was definitely a lot of speculation and exclusivity driving the price (see Veblen goods), we can try to break down the value proposition of what exactly Moonbird buyers are paying for.

In accounting, there is practice of unbundling the relative stand-alone prices of each distinct good or service in a sale. In a very layman example, if you are buying a McDonald's meal, the price of the set meal should be divided and allocated to the stand-alone burger, fries and drink. The allocated price of each of the item should make sense to you if you were to buy them individually. This can be a useful framework to assess an NFT. The NFT picture itself is equivalent to just the wrapper of your McDonald’s burger.

For Moonbirds, the meat of the pie is in the team behind that profile picture. The founder, Kevin Rose, has a good track record in early-stage tech startups before joining crypto, which is a rare breed in the PFP NFT market. Moonbird collectors are essentially acting as angel investors here. They are betting on Kevin’s experience and team execution in making the Moonbirds “company” worth a lot more. Moonbirds are also an extension of Kevin’s first NFT club collection called PROOF Collective. The collective is known for its curated NFT content, collaborations with famous artists in the space and access to a network of sophisticated NFT investors. The Moonbirds buyers possibly expect some of these value from PROOF to trickle down to their collection.

The value of community and social connection is often very vague, but should not be underestimated. The right connections can even be career- or life-defining. It is the same reason why people would pay for conferences and networking events. What is the value of a $100k MBA degree? On instinct it might be for the paper credentials and educational content. But a large portion of the value comes from the professional network with course mates and alumni.

Value is in the records

Another bullish case for NFTs is that, on top of owning something on the internet, the blockchain records down your ownership. Much like an imaginary accountant. This data is permanently stored on the blockchain, cannot be altered, and available for all to verify for authenticity. Jesse Walden denotes this as a “Z-Axis” of the 2D image, where all of its history and context can be discovered by third-parties, adding to its cultural and financial value.

Things like who created this NFT? How many were created? Who were the previous owners and at what price did they pay for? How long have the person held this NFT? How has the NFT transformed overtime? These are all public information on the blockchain. These records give context and share the story of the NFT, perhaps building it into a worthy avatar.

Furthermore, now lets say your NFT is part of a collection of 10,000 NFTs. You now have 9,999 other similar items with their own historic records to compare. This simple, collective record of quotations and transactions, by willing buyers and willing sellers, is driving the NFT market activity and speculation today. One person’s perceived value is just an imagination, but a collective group of perceived value is the “fair market price”.

Some NFTs, by their nature, will also out last your lifetime. Maybe you will own NFT collections of your favorite fine art, games or music, and they will be passed down to your children and grandchildren for generations. An NFT collectible passed down by your parents, which were pass down by their parents becomes a legacy item possessing greater perceived value.

Functional value

Now this is the interesting part. NFTs, and crypto for that matter, enable a new economic model in how value is distributed and move between participants. They are tools for creators and businesses to improve the way people consume, invest and interact.

Some collectible NFT projects like to use “airdrops” as a show of utility, by rewarding their holders more tokens or a new NFT companion collection. Generally, these airdrops should not be viewed as utility by itself. More tokens from the same ecosystem are just more “pieces of paper” as a medium of exchange. Cutting up more pieces of the same pie does not increase the size of the pie. In the traditional world, these airdrops are akin to dividends to shareholders or stock splits. Even calling them dividends is a stretch, as dividends should be strictly distribution out of a company's profits. Generally, depending on the purpose of the project, the money made by an NFT collection’s initial sale is more akin to a fund raising activity rather than revenue. But if the project founders are pocketing the funds instead of using it to build the project, then yes, you are their revenue.

Proof of Ownership/Membership

We have explored that the blockchain records your NFT transactions, hence you can declare ownership, or a membership into that NFT club. But how exactly is it better than how things work now? We can have ownership of real physical assets in our homes and sign up to number memberships/social clubs all fine without NFTs.

The advantage is that an NFT is a public proof of authenticity, without the need for third parties. It might not mean much for usual day to day items, but it is a game changer for luxury items, artwork or collectibles, plagued by counterfeiting. Without a reliable way to authenticate, secondary market activity will be muted. Card grading companies like PSA serve the role of authenticating trading cards. When card market boomed, they were overwhelmed and had to stop taking new orders even after raising prices. If a collectible, or any item for that matter, can be automatically verified for authenticity, new and engaging markets will be born.

Imagine you were just walking along the street and saw the potential of a young talented street musician. You support him by dropping $10, and in return you receive a copy of his first album as an NFT.

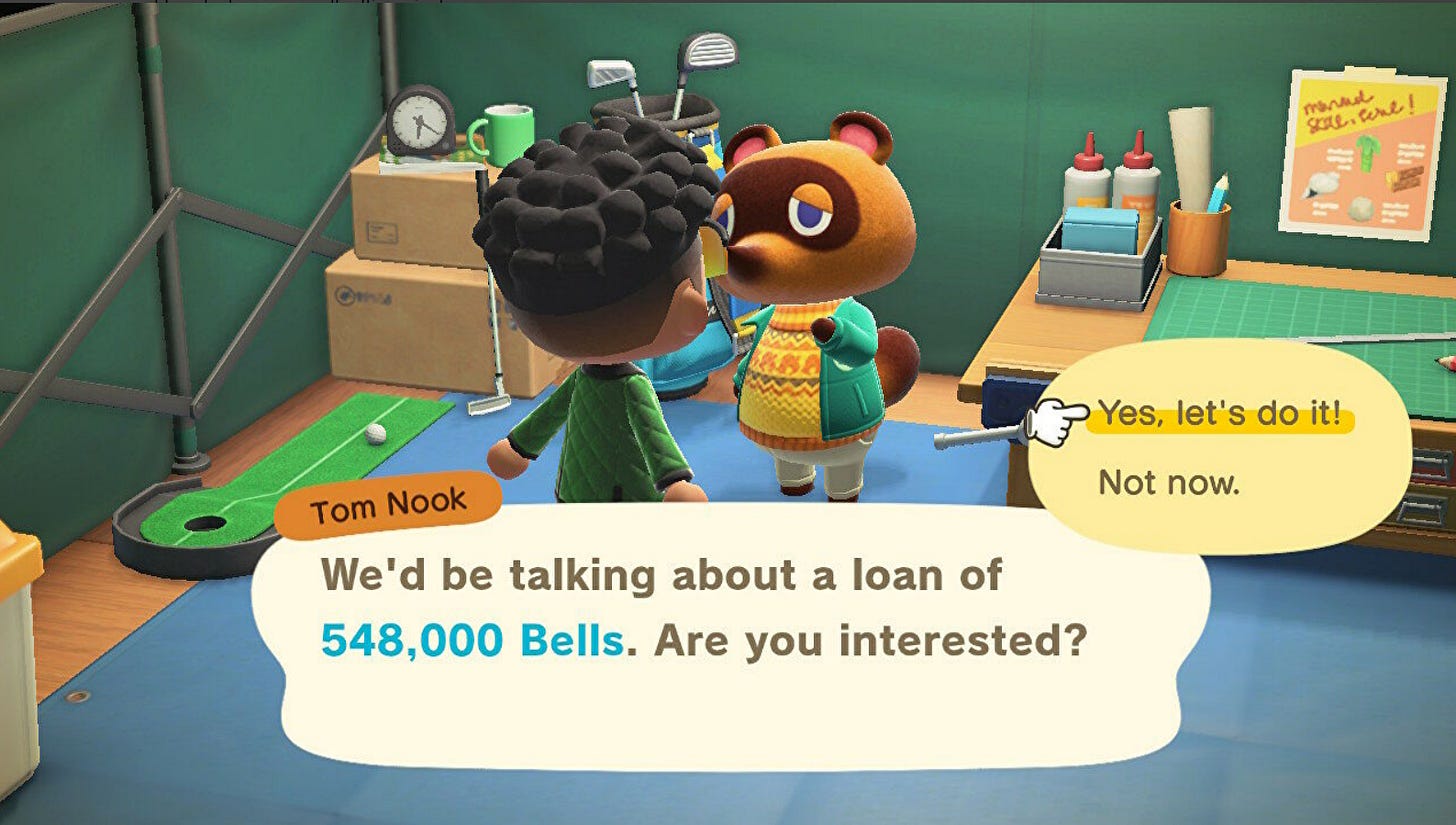

Few years later, he made it. How much do you think his first NFT collection can fetch? This NFT will be the virtual equivalent of the artist’s signed 1st edition, without the issue of trying to prove authenticity of a physical item. This shows that NFTs enable anything of interest to become investible (caveat: this definitely does not mean every NFT can be an investment). This possibility enables people to play to their strengths. Some people can never understand Balance Sheets or Price-to-Earning ratios, but can identify which music, fashion or game will become popular. I, for one, would not mind owning a Tom Nook NFT in Animal Crossing during the pandemic.

New Worldly Functions

What is the upside for creators and companies to use NFTs then?

On the internet as we know now, we gauge the success of a content creator/influencer on the number of followers/likes/views that they can garner. However, it does not have to be this way. Applying first principles thinking, the fundamental truth driving this is that the internet giants today want more data on you to sell to advertisers. The game of today’s internet is attention and advertising. Content creators are convinced to use clickbait titles, insert ads and product placements, so that YouTube or their sponsors would pay them more. This is incentive misalignment. Creators focusing on advertising is a distraction, as the followers’ time and monetary value is siphoned out of the community (creators and followers) to the middlemen (platforms and advertisers).

Also, some industries have barely advanced themselves, even as technology and the world population grew over the years:

While the gaming industry has innovated and grown through the decades, the music record labels are notorious for filing lawsuits to fight over commercial rights against their artists, rather than actually growing the industry itself.

Even with digital streaming, most musicians are still struggling. In 2020, 90% of the Spotify’s royalties are shared among the top 0.8% of artists. Spotify paid $5 billion in royalties to music rights holders during that year. Hence, the remaining 8 million artists in the bottom 99.2% earned about $63 per year on average. If they signed with any record labels, a further cut from earnings can be anywhere from 50-90%. Any other revenue sources? The era of selling CDs is over. Main income for performance artistes are world concert tours, but the pandemic killed it. Is the answer advertisements again? Do we really have to see artists promoting shampoo as their main income?

Artists and creators generally want to hone the quality of their craft. The 1,000 True Fans theory by Kevin Kelly suggests that you only need 1,000 true fans that are willing financially support you a little, to make a living. If you focus on serving that core group of fans, you will inevitability find the quality in your work that resonates, rather than shooting random shots trying to go viral for engagement farming. NFTs improves on this strategy because an NFT issuance is a direct connection between the creator and customer. Beyond the social status, the creator can bestow upon any perks into the NFTs that they think their fans desire: limited-edition items, access to VIP experiences, reserved tickets, front-row seats, voting on content direction, community networking, or even revenue sharing through royalties!

Some creators may want to form deeper connections with their fans, but don’t know how. Youtubers often mention their Patreon (a content creator membership platform) supporters at the end of their videos as acknowledgement. Patreon helps the creator economy a little, but it is really just as another middleman with the same business model, taking a cut off subscription fees in a platform controlled environment. Fans generally want more interactive access to creators and feel special. The wave of YouTube and Twitch streaming frenzy gives us a clue that people do not mind paying for more interactive experiences, as compared to showing passive support through a subscription.

As NFT holders, customers and fans now become partial owners of their idols/influencers’ brand. This creates incentive alignment. Fans are now incentivized to help their creators succeed, and become their promoters and evangelists. You just bought an Ed Sheeran NFT of the streets and like his music, now you are going to tell all your friends about it. NFTs legitimizes this ownership as people from outside can easily see and verify who are the community, how many there are, the trading history and what are the holder benefits.

NFTs will also disrupt how big consumer companies work. Alex Danco & Packy McCormick discussed in the Not Boring Article: Tokengated Commerce (a must read) that using NFTs is a fundamentally different kind of behavior. Customer accounts and loyalty programs are just not good enough. How many times have you turned down a store asking for you to fill up personal details for their membership? Or have you crushed a receipt right after a purchase? Companies want to know who their customers are and stay connected. They could accomplish this by just dropping an NFT to your wallet as the receipt. Next time, just by connecting your wallet to their store and based on the digital files inside, they will know the kind of buyer you are. No other personal or private information needed.

An NFT is a standard public file format that is sharable and recognizable by all participants. You share pictures with friends in JPEG or PNG files. At work, you share PowerPoint and Excel files. It does not matter what program or operating system your friends or colleagues use to open your files. An NFT is that standardized file format for the digital economy. This standardization will be what connects the dots and consumers will be at the center of it.

Presently, companies are playing their own game, collecting (or buying) various data on you into their own database, to sell their stuff to you individually. Instead, if digital files (that’s what NFTs are, remember?) are stored on your own wallet, all the companies have access to those data on the same playing field. This is a fundamental change in the metagame, shifting the battleground from siloed databases in centralized entities, to a user centric theatre. The consumer business will turn into an open world multiplayer game to woo you.

Multiplayer can mean both competition and collaboration. Anyone or any computer can build custom experiences based on the NFTs in peoples' wallets. You are a fan of Brand A and Brand B? Congrats, they are doing a collaboration so here is an airdrop of a limited edition cross-brand item and an invite to their exclusive event. You are a frequent customer of Brand A? Competitor C wants you to know that they have product you would love at a 50% discount. These are just the low-hanging fruit examples. The possibilities are endless when we have universally agreed standard Lego blocks that allow anyone to start building on top of each other.

Free Market Efficiency

Things on the internet travel at ultra speeds. Now imagine your NFT is linked to a real world asset. Your physical asset now inherit properties of the fast, uncensored and borderless internet.

Industries with high demand but low volume benefits the most from this. Kevin Rose used the wine industry as an example on a Bankless podcast. Small high-end wine producers can take years to fulfil overwhelming orders by buyers, and the wine can sometimes change hands 6 to 8 times until settling with the ultimate consumer. Many issues arise like whether the wine was stored and shipped properly at the right temperature, whether the wine touched the cork so it didn’t go dry and whether it got replaced fraudulently. Instead, the winemaker can issue NFTs as the ticket on the waitlist to redeem the wine. The NFTs can be traded around instead of the actual wine itself. There will be no issues of storage as the wine is properly stored in the vineyard, no wastage in multiple shipping between resellers, and no fraud as the NFT is verifiably created by the winemaker. The winemaker can also set a royalty fee on the NFT transactions, so they get a cut from the secondary market.

Flyfish Club seems to be experimenting on this idea as fine dining restaurant. Customers need to hold the Flyfish Club NFT to make reservations for their exclusive private dining experience, prepared with premium ingredients imported internationally. At times of excess demand, the restaurant benefits by leaving the allocations up to the free market and earning royalty income as the NFTs change hands.

Companies also have the difficulty in estimating actual demand and how much to produce. Luxury brands overproduce to cover demand but destroy the excess goods to prevent an oversupply from cheapening of the brand, causing huge wastage. If NFTs were sold first, producers can determine the exact demand down to a tee. adidas did this with an initial sale of NFTs, with the promise of 3 exclusive physical merchandises, claimable at separate time windows that they had set. When claiming online, the customer simply connects their wallet and enters just their shipping address. adidas will then burn the original NFT (labeled phase 1), and issue the customer a new NFT (phase 2) to be used for future claims. adidas only ever needs to produce the exact amount of goods as the number of NFTs that have they sold. If a customer ever changes their mind, they can simply list the NFT on the secondary market at anytime.

In the earlier section we explored that the NFTs inside your wallet helps companies know the kind of buyer you are. Using this information, we can optimize distributions even better and, perhaps, fairer. Sony’s PlayStation 5 (PS5) release was famously known to be a disaster, being plagued by pandemic related supply chain issues, high demand for stay-at-home hobbies, and last but not least, the dreaded scalpers. Lets say Sony wants to make sure their product fall into the hands of their loyal customers, they could easily identify the buyers based on the what is in people’s digital wallets. The targets could be wallets holding an NFT receipt from a PS4 purchase, an NFT with a long track record of the PlayStation subscription, or 10 NFT receipts of PS5 game purchases. Sony could just airdrop to these people the NFT for the right to buy a PS5. Want to attract new buyers? Allocate some to buyers of other Sony products, some to promotional events, or some to customers of competitor brands. Still have scalpers and flippers? At least buyers have the transparency of what is the universal lowest listed price in the secondary market.

Somehow, if NFTs are used properly, there can be a world where everyone wins (wagmi). The companies get improved distribution methods and gain an additional revenue stream through royalties. The buyers get access to a transparent, global and frictionless secondary market with no frauds. Even the resellers also win, as in economics, they get higher “consumer surplus”. If a person’s enjoyment of having earlier access to a PS5 is worth $800, they would sell the NFT voucher (the right to buy a PS5 at retail price of $500) if price of NFT is >$300. These resellers are receiving extra value in return, by giving up the item at a higher price than what they were willing to pay for.

In sum

NFTs are valuable to people, be it the value that they perceive to be getting, or value from their usefulness in the real world. That said, please do not go and buy the next NFT you see after reading this article. You will find that most NFTs today are speculative do not inherit the value from points raised here. Hopefully, this framework can help you to explore some NFT theses and serve as a down to earth guide when the markets get too wildly euphoric or extremely depressing.

Side note

Somehow, I managed to write a whole article about NFTs without mentioning the “Metaverse”. Better explain one buzzword at a time. The role of NFTs in gaming and metaverse deserves another article on its own.

Disclaimer

Not financial or tax advice. Any personal opinions and specific projects mentioned are purely for education purposes. This article and its points are by no means a fully comprehensive guide and should be viewed as a supplement to the reader’s individual framework. Feedback is welcomed.